🥳 Holiday Special: Get 50% OFF your FIRST 3 MONTHS of Master Your Money now through 12/29!

tired of Living Paycheck to Paycheck?

Walk Into 2026 With Complete Control Over Your Budget, Zero Money Stress, and a Clear Path to the Life You Actually Want

this deal ends in...

before it's gone forever.

Master Your Money™ gives you the courses, community, and tools to finally fix your relationship with money. No more guessing. No more panic. Just results.

You've been here before. Maybe three times. Today, let's try something crazy: Actually clicking the button.

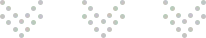

Let's Be Honest About Where You Are Right Now...

You make decent money.

You're not lazy.

You're not stupid.

But you're still broke.

You check your bank account and feel that pit in your stomach.

You avoid opening bills.

You tell yourself "next month will be different" but it never is.

You've tried budgeting apps. You've watched YouTube videos. You've told yourself you'll get serious about money a hundred times.

And here you are. Same place. Same stress. Same cycle.

Here's why:

You don't have a system.

You don't have accountability.

You don't have anyone keeping you on track when motivation runs out.

You're winging it. And winging it doesn't work.

2025 is almost over.

You can start 2026 the same way you started 2025, or you can actually fix this.

Master Your Money Is the Complete System You've Been Missing

This isn't another budgeting app you'll ignore in three weeks.

This isn't another course you'll buy and never finish.

This is the full ecosystem that makes financial change actually stick:

7 complete courses that teach you everything from budgeting basics to investing and real estate.

An active community of real people who are figuring this out with you, not fake motivation from bots.

Weekly fresh content that keeps you engaged, accountable, and moving forward.

The DollarWise budgeting app built specifically for people using the Hammer Method.

Monthly challenges with real prizes that gamify your progress and keep you motivated.

Direct support from certified guides when you get stuck.

You get the education, the tools, the community, and the accountability all in one place.

That's why it works when everything else failed.

Finally, Say Goodbye to Money Stress, Broke Cycles, and Budget Confusion

NO MORE Sunday night panic when you realize you have $47 until Friday

NO MORE avoiding your bank app because you're scared of what you'll see

NO MORE wondering why you make decent money but still feel broke

NO MORE starting over every few months because nothing sticks

NO MORE doing this alone and hoping it works out this time

Master Your Money™ fixes what's been broken. You get clarity, control, and a system that actually works.

here's Everything You get as a

'Master Your Money' Exclusive Member

(plus your first 3 months 50% off)

📚

Foundation Courses:

Worth $1,497

✓ Financial Fundamentals

✓ Master Your Budget

✓ Master Your Debt

💰

Wealth Building:

Save $240/year

✓ Master Your Investing

✓ Master Your Real Estate

✓ Master Your Income (2026)

🛡️

Crisis Protection:

Worth $1,497

✓ Recession Survival Guide

✓ Income Calculators

✓ Savings Calculators

💬

Daily Support:

Save $240/year

✓ Private Community

✓ Weekly Money Minutes

✓ Seasonal Challenges

Lifetime Access to the DollarWise Budgeting App

Everything you need to fix your finances and start your journey to financial freedom.

✓ Custom Categories: Tailor unlimited categories to match your lifestyle.

✓ Real-Time Spending Updates: Know exactly where your money goes, as it goes.

✓ Easy Goal Setting: Create savings targets you can actually hi, think vacations, emergency funds, or debt paydowns.

✓ Paycheck Planning: Align budgets with when you get paid, so you’re never caught off guard.

Introducing 'Master Your Money':

Built for 2025, Not 1987

This isn't...

Advice from your parents' era.

We acknowledge that rent is 40% of your income (not 25%). That student loans exist. That you want to actually live before you're 67.

Punishment like Dave Ramsey.

Budget your actual life. Yes, including DoorDash (just not $340/month). Travel. Eating out. Fun. Financial responsibility without self-hatred.

Data entry like apps.

We teach you WHY you spend. HOW to change behavior. WHAT to do instead. Not just "you spent $4.32 at Taco Bell."

Contradictory chaos like YouTube.

This is...

Why Master Your Money Works When Everything Else Failed

Most people fail at budgeting because they try to do it alone with no support.

You get motivated. You start strong. Life happens. You fall off. You feel bad. You quit.

Master Your Money™ breaks that cycle with a three-phase system:

🥱 Phase 1: Wake-Up Call (Days 1-7)

Complete Financial Fundamentals. Build your first real budget.

The moment: "Holy shit. THAT'S where $840/month goes?"

Unlike others: No shame. Just math.

😏 Phase 2: Habit Shift (Days 8-21)

Daily community. Weekly updates. Debt/budget courses.

The accountability: Real people won't let you order DoorDash at 11pm.

What you'll notice: It gets easier. Credit card balance shrinks. Money left on the 28th.

🤑 Phase 3: Wealth Build (Days 22-90)

Advanced courses: Investing, Real Estate.

The transformation: From paycheck-to-paycheck to "I have a plan."

What you'll notice: 4-digit savings. Debt disappearing. Actually building wealth.

Education + Accountability + Tools + Community = Actual Results

You're not alone. You're not guessing.

You're following a proven path with hundreds of other people.

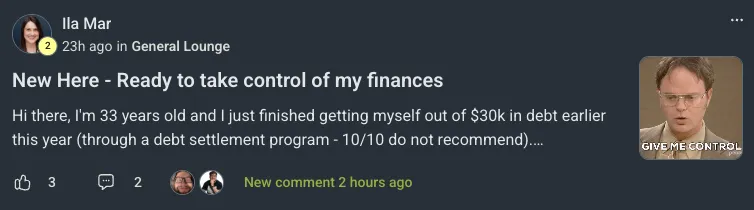

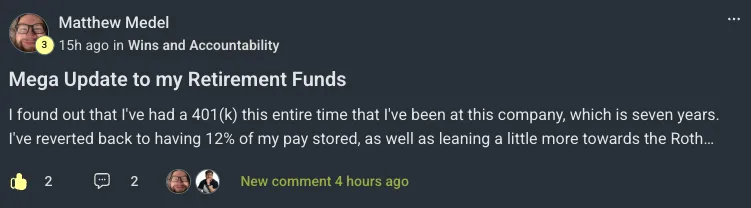

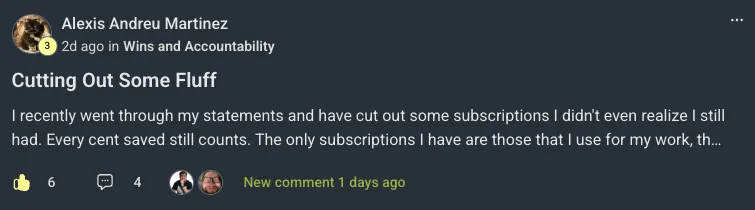

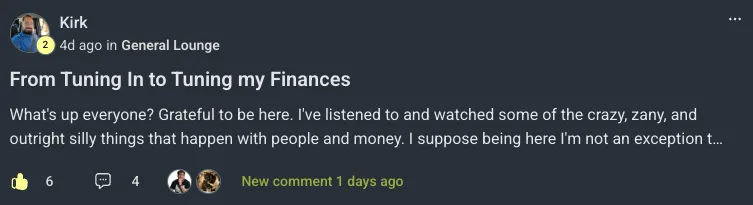

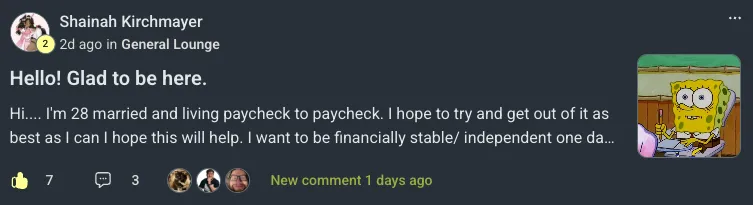

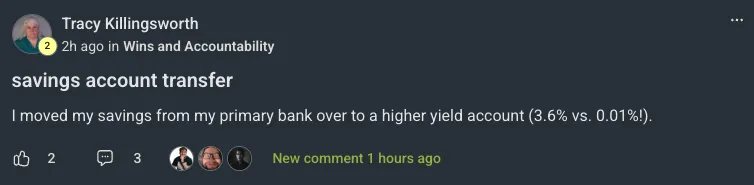

did I forget to mention, Our Community is already thriving

(and we're just getting started...)

Here's What Makes 'Master Your Money' Different

Simple, Step-by-step videos you can actually follow

Real-life tools and templates — not boring theory

Self-paced — go as fast (or slow) as you need

Designed for real people — not spreadsheet nerds or finance bros

Built-in accountability — the support you need to stay consistent

Start 2026 With Your Money Fixed So You Don't Start Another Year Broke

If you join Master Your Money today:

You start 2026 with a working budget

You have a community keeping you accountable

You have the tools and courses to build wealth

You stop the paycheck-to-paycheck cycle for good

You save $300/year compared to paying separately

You get instant access to everything right now

If you don't:

2026 starts the same way 2025 did

You keep winging it and hoping things magically improve

You stay stuck in the same broke cycle

You pay full price later or never fix this at all

Another year passes and nothing changes

Real talk:

You've been thinking about fixing your money for how long? Months? Years?

2025 is almost over.

You can end this year with a real plan or start 2026 exactly where you are now.

Your call.

Stop Thinking About It. Start Fixing It.

You've read this far because you know something needs to change.

You make decent money but you're still broke.

You've tried fixing this before and it didn't stick.

You're tired of the stress, the panic, and the cycle.

Master Your Money is the system that fixes it.

$25 bucks a month for the first 3 months. Cancel anytime.

All 7 courses, DollarWise app, community, weekly content, challenges, and support.

You can start 2026 with your finances under control or you can spend another year hoping things magically improve.

Complete Your Holiday Enrollment Before This Discount Expires!

Normal Price $49.99 → VIP Offer: 50% OFF your FIRST 3 MONTHS!

👉 Use Coupon Code: MYM50

⬇️ PUT IN YOUR INFORMATION BELOW AND LET'S GET STARTED! ⬇️

Recession Proof Your Budget in 1 Hour - Only $12

Add The Ultimate Guide for Recession Survival for just $12, and you'll get the exact strategies I use to protect my finances when times are tough, so you can keep your own money safe no matter what.

Lock In Your Discount Pricing Now...

OR...

DISCLAIMER - No Advice or Endorsement.

By accessing Financial Audit with Caleb Hammer, calebhammer.com, dollarwise.com, the DollarWise Budgeting mobile application, and any other content or information

provided by Caleb Hammer or Hammer Media, regardless of where published or provided (collectively, “Hammer Content”), you acknowledge that you have read, understand and agree to be bound by the following disclaimers, and you release Caleb Hammer, Hammer Media, and their affiliates, members, officers, employees, and agents from any and all liability whatsoever relating to your use of Hammer Content and any linked content or information.

You hereby acknowledge, understand, and agree that: (i) Hammer Content is strictly for informational and educational purposes only; (ii) Hammer Content is not intended to be, and you should not construe Hammer Content as, legal, tax, investment, financial, or other advice; (iii) nothing in the Hammer Content constitutes professional and/or financial advice, nor does any Hammer Content constitute a comprehensive or complete analysis of the matters presented or the law or regulations relating thereto; (iv) your access to or use of Hammer Content does not create, and shall not be construed as creating, any advisor-client, fiduciary, or other professional relationship between you and Caleb Hammer or Hammer Media; (v) you alone assume the sole responsibility of evaluating the merits and risks associated with the use of, or reference to, Hammer Content and any decisions you make based on such Hammer Content; (vi) references to any third-party websites, products, services, resources or individuals within Hammer Content are provided solely for informational purposes and do not constitute or imply any endorsement, sponsorship, recommendation, or affiliation by Caleb Hammer or Hammer Media; (vii) Caleb Hammer, Hammer Media and their respective affiliates, members, officers, employees, and agents shall not be held responsible or liable for any claim, loss, or damages of any kind, whether direct, indirect, incidental, consequential, special, exemplary, or other otherwise, arising from or relating to your use of, or reliance on, the Hammer Content or any associated content or information; and (viii) the Hammer Content may be incomplete, inaccurate, untimely, or contain errors, Caleb Hammer and Hammer Media make no representation, warranty, or guarantee, express or implied, regarding the accuracy, reliability, completeness, or timeliness of Hammer Content, and all Hammer Content is provided strictly on an “AS IS” and “AS AVAILABLE” basis without any warranty of any kind.